EXPECTED UTILITY THEORY

We live in an uncertain world. Timing events where too many interactions are happening could be risky especially when it comes to money or the basic resources for sustenance. In crisis situations, our survival instincts have always kicked in to ensure preservation of life and the resources required to ensure its longevity. They need not to be always rational, they are just meant to save life somehow, that is why most of the acts of survival seem extraordinary. Interesting thing to understand here is that when such extraordinary survival instincts kick in as a mass effect the whole mass effect becomes irrational, unexplainable, incoherent. There is no sane explanation to justify these mass events. When such events badly affect the resources responsible for basic life of every being, it can be catastrophic. Huge sudden falls in stock market are good indicators of such disasters, crises. Insurance on the other hand could prepare person to handle the disasters in a preventive way. Stock market and insurance are one of the best examples to understand how people assess risk and maintain/ reject rationality while making important decisions. We will see what formal ideas from economics lie behind these events of uncertainty.

Expected Utility Theory (EUT) in Economics

Expected utility theory lays the foundation of how a rational person would make decision in an uncertainty where valuable resources like money are involved. The whole idea is based on the quantification of that uncertainty and connecting that uncertainty with the individual gains from individual uncertain event. Expected utility also creates a formal structure of how person perceives risk in given scenario. This helps to quantify the value generated from any economic event.

Origin – St. Petersburg Paradox

Daniel Bernoulli is credited to establish the expected utility theory which is one of the foundations of economics. The theory emerged from the St. Petersburg Paradox which goes like this:

You have $2 and we toss a coin. Heads, the amount you have now is doubled and tails then the game stops and you leave with whatever amount you have right now. The game continues till its always heads in series and stops when the coin shows tails.

The question is how much will you be willing to pay to enter this bet?

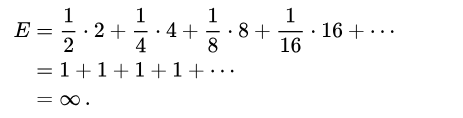

The probability of heads and tails is 50-50% which is ½ . If it is a series of heads (heads followed by heads) then the events are dependent on each other, so the probability of this event is intertwined with the probability of the previous one. If there happens a game where you start with $2 and every time heads comes, and the money goes on doubling the equation of gain would be:

As this math goes, a person should pay infinite amount as he will be gaining infinite amount from such game. ‘E’ value here is identified as expected value. Even if one such possible game would happen in reality, people won’t pay infinite amount in reality to enter this bet.

Bernoulli resolved this paradox by creating the concept of Expected utility. People will pay not what actual value it delivers (as in the $s of money); they will pay according to how actually it will be useful to them, ‘utilizable’ to them – that is where the utility and thus expected utility comes in picture.

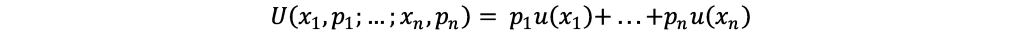

Expected utility is calculated by the amount one would gain and the chances of gaining that amount. The expected utility thus is sum of all the gains connected with the probabilities of gaining them.

The determination of the value of an item must not be based on its price, but rather on the utility it yields.

1st Tenet of EUT: Expectation

The overall utility of a prospect, is the expected utility of its outcomes.

In very simple words, for a given scenario you will weigh the chances of its constituent events and connect them with their respective gains. The sum of the all connections of each gain with their chance of realization is the usefulness – utility of that scenario.

Mathematically,

Expectation:

In our example we need to assume something that is the usability of the money – utility.

We assume $10 has utility of 1 unit. (This is just an assumption to understand the concept. When multiple objects are involved, their utilities will be different.)

So, the expected utility of this scenario is:

E = ((1000/10)x0.2) + ((50/10)x0.65) + (10000)x0.15) =

20 + 3.25 + 150 = 173.25 units

So, the expected utility – the usefulness of this event is 173.25 units.

The unit of value which we assumed in this calculation is sometimes called ‘utils’ – the basic unit of utility. It will change based on how one perceives the value in given scenario.

You will realize that the expected utility is the weighted average of utility of events and their individual probabilities.

Four Axioms of Utility Theory

Later John von Neumann and Oskar Morgenstern expanded the concept of EUT with the idea of rationality. The agents involved in such uncertain economic exchanges are ‘econs’-the rational beings.

They have clear preferences among the options provided in every economic decision which comes under the idea of “completeness”. If out of the given set they select multiple options at a time, then it is said that they are ‘indifferent’ to these options. Whatever might be the internal distribution of constituent they might have. It’s about the final utility they perceive. When presented with choices, a rational person has clear preferences for those choices.

For all given uncertain events there is a hierarchy of preferences. If A is preferred over B and B is preferred over C, then A is always preferred over C. Which goes as transitivity.

Suppose we have been presented three events where event A is preferred over B and B is preferred over C. Now if one introduces a new event N which is slightly less preferred than B and more preferred over C then event B and N would be indifferent. In simple words, the choices between options would never directly jump, they will align as per the preferences in line.

So, A>B>C and B>N>C then A>B>C and A>N>C mean the same.

This is continuity. Graphically, the utility function is always a smooth curve.

Why do A>B>C and A>N>C mean the same even when the calculated numeric value would differ? It is because utility is never an absolute value it is just used to arrange the preferences by quantifying them. Ground rules used to define usability from the given resources i.e., the utility function of given scenario will be different for different scenarios and different sets of people. This is simplification of the concept called ordinality of utility. You can rank utility but not say that event A is this many percent better than event B.

When you have set the preferences of A over B and if you are offered another totally different/ irrelevant event M with new utility. You would still prefer A over B. Introduction of M will not affect the preferences as if A and B are independent of M. This is called ‘independence‘ in EUT.

So, completeness, transitivity, continuity and independence are the four axioms of EUT. Note that they are not ‘complete’ representation of reality. It’s just that they bring in simplicity to treat given scenarios and evaluate them. That is why you will find contradictions to these axioms. (Maybe a topic for another time.) The axioms are there to create a formal mathematical structure to draw useful inferences.

2nd Tenet of Expected Utility Theory: Asset Integration

In EUT, asset integration is an idea based on the assumption that all people making economic decisions are rational. So, in uncertainty or risky scenarios a rational person will look at the overall gains instead of focusing on one certain gain and neglecting other unsure gains. A rational person will look at the risks of scenarios in a collective way and decide to enter only if the expected utility improves his assets’ position. A rational person will only enter the given scenario if the collective utility is better than the individual utility of its sub-events or sub-gains.

A rational person will not focus on an individual more probable gain even when his overall gains are becoming low.

3rd Tenet of Expected Utility Theory: Risk

The beautiful insight EUT creates is about the mathematical formalization of risk profile. For that we will understand some ideas in advance.

Utility function – it is a mathematical relation between how one sees the value of given object/ resource. The value of resources is different for different people. A crude example would be how a beggar values money for one time meal compared to a filthy rich person. The value of $25 would be different for different people based on the conditions they are in.

This is where marginal utility comes in picture.

Marginal utility talks about what difference it makes in your perception of the value of a given thing if one would give you more of that in the next event. Roughly speaking the more we have something, the less we value it, so marginal utility is always diminishing. If I already have 10 packets of chocolates which are enough for the day to me, the next 11th packet of chocolate won’t make that much difference in my current excitement of having 10 packets. (Please note that we are talking about rationality here, although nobody is rational when it comes to chocolates.) A rational version of me would trade that 11th packet for something else with a person who hasn’t received even a single packet. A person who has no chocolate would perceive that single packet with higher value than how I perceived it (provided that he loves chocolates).

‘Marginal Utility’ through his book ‘Principles of Economics’ in 1890.

So, utility function is a mathematical transformation of objects in given event to a unitary value so that the results can be easily compared with each other because the transformation converts everything to single unit system. These single unit of value is called ‘util’.

Utility function can be any possible mathematical relation. Generally, it is expected to be simple to not invite the complexities in modeling of given economic scenario. It should be simple enough to draw realistic conclusions.

An understanding of utility function gives insight into how the person evaluates risk with respect to the resources they hold.

Consider a scenario:

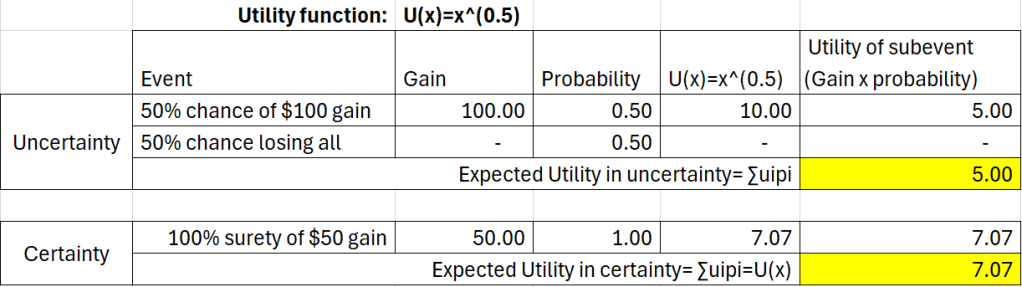

Event 1 – You enter a lottery where there is 50% chance that you will win $100 and 50% chance that you win nothing.

Event 2 – You are given $50 for sure, unconditionally just for playing the lottery.

Assume we have three differently thinking people to make choices in this scenario. Different thinking means how they assess the risk of entering the lottery which has some uncertainty and the surety of winning $50. Difference in assessment of risk means difference in the perception of utility. It further means that the utility function will be characteristic to each person.

Person 1 has the following utility function:

So, for Person 1 the utility of certainty (7.07 utils) is higher than the uncertainty (5 utils). He is happy to walk away with sure $50 gain instead of betting for $100 lottery.

Person 1 doesn’t want to take risk by entering the Event 1 of betting when he is sure about gain of $50 in Event 2. This is risk-averse behavior. The utility function mathematically models that risk averse behavior. Utility function is concave in risk aversion.

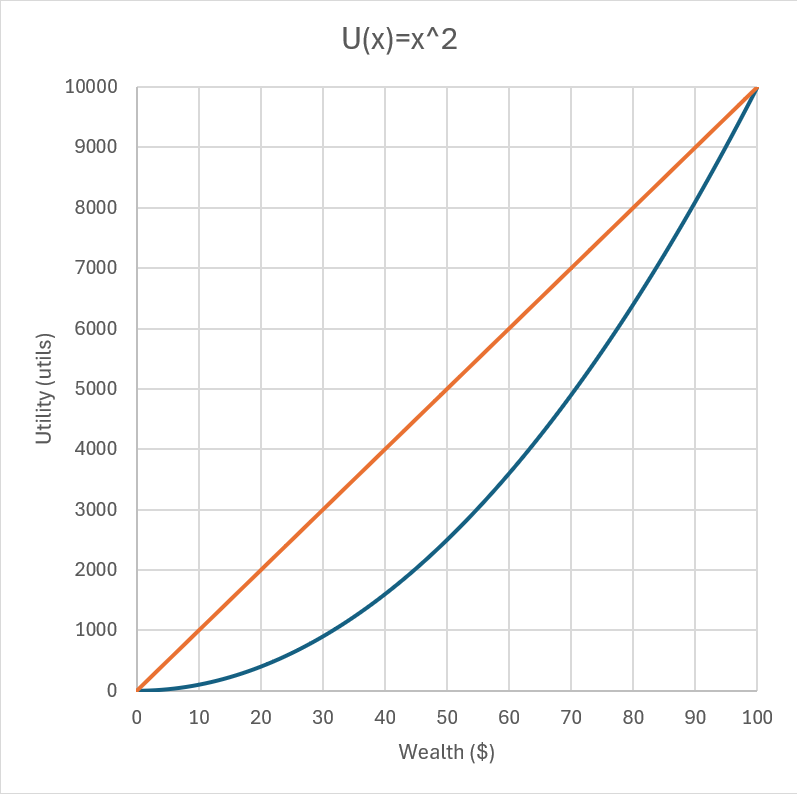

Now comes Person 2 with the following utility function:

You will see that the utility of certain and uncertain choices is the same. It means that it doesn’t matter for this guy if he enters the lottery having uncertainty or gets $50 for sure. This is risk-neutral behavior. The person 2 doesn’t care about certainty or uncertainty. He values both events the same. As mathematically both have similar utilities. Person 2 is indifferent to both events.

Now see the Person 3 with following utility function:

This guy has a radical view, he perceives the worth of entering the lottery (5000 utils) better than gaining $50 for sure (2500 utils). This guy is gambler! He finds it more interesting to enter the bet instead of gaining $50 for sure. He is happy to take the risk in uncertainty.

Looking at these three people you should note that the scenarios/ events they are presented are exactly the same. The only thing which is different is how they see the value in lottery and the sure gain.

So, the first person demonstrates risk averse behavior. He wants surety of gain rather than gambling for higher but unsure gain.

The second person demonstrates risk neutral behavior. Bet or no bet he doesn’t care. Just be done with it.

The third person demonstrates risk loving behavior. He wants the thrill of uncertainty in betting, so he sees more value in uncertainty of lottery.

This is how Expected Utility Theory can be implemented to mathematically model how different sets of people/fund managers will make decisions based on the risk profile. The relation between expected utility (which is the weighted average of gains) and utility function (which shows how one values the gain) can show us the risk profile.

In the graphs shown, blue lines show utility function and the orange lines show expected utility. The orange line in our case connects the utility of $100 and $0 which is Event 1. This orange line connects any points on utility curve and it will give the expected utility value for that scenario of uncertain gain. In simple words, it’s the line of weighted average exactly like the definition of expected utility. This line is used to find out the certainty equivalent (CE). A certainty equivalent is the utility of an uncertain gain if it was certain.

Almost all the time, people are risk averse. People want to avoid uncertainty about higher gains when they are presented with some lower but sure gain. This is where marginal utility becomes important. (This point deserves broad explanation which we will cover another time under Prospect Theory)

Marginal Utility

In risk averse people, you will see that the utility function starts to flatten out once the value gained increases. The more value someone already has the less he values the next addition of bunch into the preexisting bulk. Remember the chocolate box example?

One with 10 boxes of chocolate perceives one additional box with less value, whereas some with no chocolate will see it as a precious one as he has nothing right now. The perceived value of the additional next lot goes on reducing. This is known as diminishing marginal utility. Marginal utility is always diminishing.

So, a safe playing person would stop entering the next gamble because he now has enough. The next uncertainty in gambling has less value for him.

EUT in actuarial

Now it is obvious that only a risk averse person would go for conservative approach in uncertainty. This also means that risk aversion will also invite preventive measure against loss of certain assets, resources. Insurance thus comes into the picture. EUT here helps to mathematically formalize the probability of the risks which would compromise current gains, the perceived value of asset/ property/ resource and losses one can bear. We can now calculate the premium for the insurance against uncertainty of loss of something.

So, we will look into a scenario where risk aversion exists thus marginal utility is always diminishing.

We have the utility function of a man has a property giving revenue of $100K/year as:

u(x)=ln x

Now will see the risk scenario. Suppose this person does a fire audit of his property and the auditing agency finds out that there is 50% chance that he will suffer a loss of $60K/year due to fire hazard and 50% chance that nothing will happen.

After rephrasing, the gains from the property would look this:

50% chance that the income is $40K/year and 50% chance that income is $100K/ year.

Using the tenets of EUT the mathematical expression becomes:

Now, what we are doing differently here is to find out what this expected utility in uncertainty means when there is complete effect of loss with some chance and gain of some chance. In earlier examples we had second event of certainty against which we compared to understand the risk profile. Now it’s reverse calculation, we know the risk profile, we know the perceived overall value i.e., EUT of the property. Now we will find the certainty equivalent (CE) using the risk profile which can be explained by the utility function of the person.

How much is this 11.05 utils in terms of money from the property for this guy? We can find this from utility function of the person.

ln(x)=11.05, thus x=$63245.55

Now, think the fire hazard as a lottery where you gain $63245.55 money as per EUT calculation. Whether the fire will happen or not, the possible overall earning from this property would be $63245.55.

Now, if the property without any fire hazard was giving me $100k and the insurer guarantees me that same earning for the losses due to hazard. How much maximum amount should I pay to the insurance agency?

I will pay only that much amount which falls short to the $100k when compared to perceived earning calculated from the combined effect of certainty and uncertainty as given by EUT.

My earing due to uncertainty is $63.2k/year, I would receive $100 for a fine year so in order to continue that $100k even for a worse year I would pay insurance agency = $100000 – $63245 = $36754.45.

Anything I am paying above $36754.45/ year for insurance premium is loss for me. I would not go above this amount to insure my property which guarantees income of $100k per year. This is how the insurance premium is decided.

Conclusion:

We have many philosophical ideas about how money is not everything in life but deep down everyone knows that money constitutes a bigger portion of who we are. Although money can’t buy everything, the unexplainable value it holds behind presence of almost everything in our lives will never go unnoticed. We know that this importance of money/ resources/ assets is highly dependent on how much of these we have right now and how much of those may get lost. This perception of value drives our decision making in risky situations. The mathematical formalization of the perception of wealth, our risk profile is facilitated by expected utility theory. Although this theory has its own limitations it lies at the foundation of the economics.

For further reading:

- Von Neumann, John, and Oskar Morgenstern. “Theory of games and economic behavior: 60th anniversary commemorative edition.” Theory of games and economic behavior. Princeton university press, 2007

- Kahneman, Daniel., and Amos Tversky. “Prospect theory: An analysis of decision under risk.” Econometrica 47.2 (1979): 363-391

- Thinking fast and slow – Daniel Kahneman

- Connecting money with sentiments – Behavioral Economics

- Settling accounts with the losses – On Prospect Theory